Table 1. 2014 Taxable Income Brackets and Rates | |||

|

Rate |

Single Filers |

Married Joint Filers |

Head of Household Filers |

|

10% |

$0 to $9,075 |

$0 to $18,150 |

$0 to $12,950 |

|

15% |

$9,076 to $36,900 |

$18,151 to$73,800 |

$12,951 to $49,400 |

|

25% |

$36,901 to $89,350 |

$73,801 to $148,850 |

$49,401 to $127,550 |

|

28% |

$89,351 to $186,350 |

$148,851 to $226,850 |

$127,551 to $206,600 |

|

33% |

$186,351 to $405,100 |

$226,851 to $405,100 |

$206,601 to $405,100 |

|

35% |

$405,101 to 406,750 |

$405,101 to 457,600 |

$405,101 to $432,200 |

|

39.6% |

$406,751+ |

$457,601+ |

$432,201+ |

|

Table 2. Payroll Taxes, 2014 | |||

|

Taxable Earnings |

Social Security |

Medicare |

Total |

|

$0 - $117,000 |

12.40% |

2.9% |

15.3% |

|

$117,000 - $199,000 |

0% |

2.9% |

2.9% |

|

$200,000 and over |

0% |

3.8% |

3.8% |

|

Source: Social Security Administration (2014). | |||

Table 3. Tax Wedge of Average Income Earner by OECD Country, 2013 | |||||||

|

|

Social Security Contributions |

| |||||

|

Country |

Rank |

Total Tax Wedge |

Income Tax |

Employee |

Employer |

Average Labor Costs |

|

|

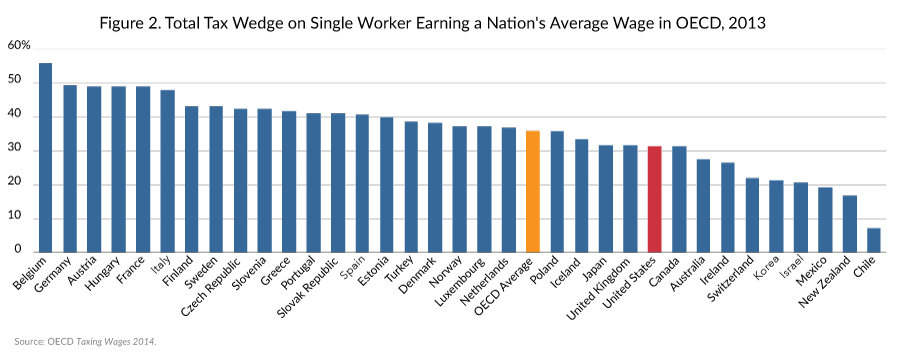

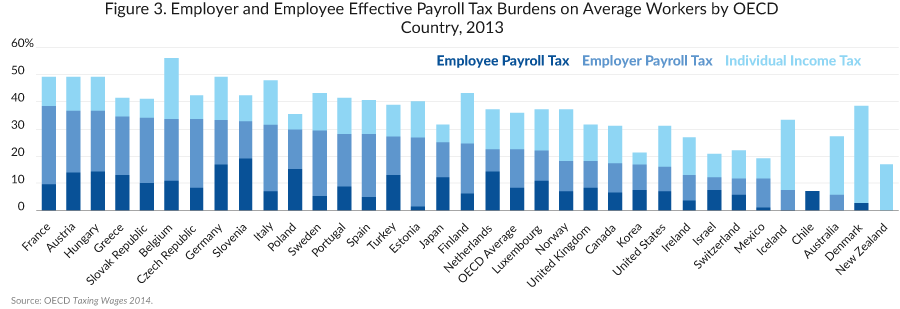

Belgium |

1 |

55.8% |

22.0% |

10.8% |

23.0% |

$ 72,974.00 |

|

|

Germany |

2 |

49.3% |

16.0% |

17.1% |

16.2% |

$ 68,962.00 |

|

|

Austria |

3 |

49.0% |

12.6% |

14.0% |

22.6% |

$ 64,980.00 |

|

|

Hungary |

3 |

49.0% |

12.5% |

14.4% |

22.2% |

$ 29,465.00 |

|

|

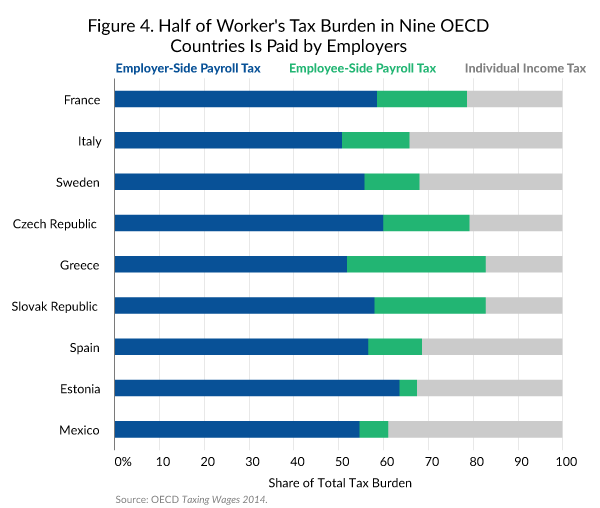

France |

5 |

48.9% |

10.4% |

9.8% |

28.7% |

$ 61,648.00 |

|

|

Italy |

6 |

47.8% |

16.3% |

7.2% |

24.3% |

$ 52,080.00 |

|

|

Finland |

7 |

43.1% |

18.4% |

6.2% |

18.6% |

$ 57,406.00 |

|

|

Sweden |

8 |

42.9% |

13.7% |

5.3% |

23.9% |

$ 59,649.00 |

|

|

Czech Republic |

9 |

42.4% |

8.8% |

8.2% |

25.4% |

$ 30,096.00 |

|

|

Slovenia |

10 |

42.3% |

9.4% |

19.0% |

13.9% |

$ 34,282.00 |

|

|

Greece |

11 |

41.6% |

7.1% |

12.9% |

21.5% |

$ 40,650.00 |

|

|

Portugal |

12 |

41.1% |

13.1% |

8.9% |

19.2% |

$ 35,511.00 |

|

|

Slovak Republic |

12 |

41.1% |

7.1% |

10.2% |

23.8% |

$ 25,867.00 |

|

|

Spain |

14 |

40.7% |

12.8% |

4.9% |

23.0% |

$ 49,723.00 |

|

|

Estonia |

15 |

39.9% |

13.0% |

1.5% |

25.4% |

$ 28,430.00 |

|

|

Turkey |

16 |

38.6% |

11.6% |

12.9% |

14.2% |

$ 34,293.00 |

|

|

Denmark |

17 |

38.2% |

35.8% |

2.7% |

0.0% |

$ 51,772.00 |

|

|

Norway |

18 |

37.3% |

18.9% |

6.9% |

11.5% |

$ 67,289.00 |

|

|

Luxembourg |

19 |

37.0% |

15.1% |

11.0% |

11.0% |

$ 64,680.00 |

|

|

Netherlands |

20 |

36.9% |

14.3% |

14.2% |

8.4% |

$ 63,585.00 |

|

|

Poland |

21 |

35.6% |

5.9% |

15.3% |

14.4% |

$ 26,822.00 |

|

|

Iceland |

22 |

33.4% |

25.9% |

0.4% |

7.1% |

$ 48,334.00 |

|

|

Japan |

23 |

31.6% |

6.7% |

12.2% |

12.8% |

$ 54,790.00 |

|

|

United Kingdom |

24 |

31.5% |

13.3% |

8.5% |

9.8% |

$ 56,797.00 |

|

|

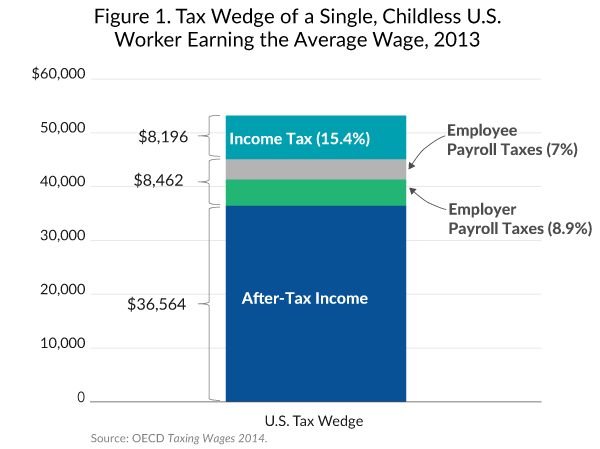

United States |

25 |

31.3% |

15.4% |

7.0% |

8.9% |

$ 53,223.00 |

|

|

Canada |

26 |

31.1% |

13.7% |

6.6% |

10.8% |

$ 43,643.00 |

|

|

Australia |

27 |

27.4% |

21.8% |

0.0% |

5.6% |

$ 55,766.00 |

|

|

Ireland |

28 |

26.6% |

13.3% |

3.6% |

9.7% |

$ 44,494.00 |

|

|

Switzerland |

29 |

22.0% |

10.2% |

5.9% |

5.9% |

$ 68,317.00 |

|

|

Korea |

30 |

21.4% |

4.6% |

7.5% |

9.3% |

$ 51,895.00 |

|

|

Israel |

31 |

20.7% |

8.4% |

7.5% |

4.8% |

$ 34,046.00 |

|

|

Mexico |

32 |

19.2% |

7.5% |

1.2% |

10.5% |

$ 13,964.00 |

|

|

New Zealand |

33 |

16.9% |

16.9% |

0.0% |

0.0% |

$ 36,381.00 |

|

|

Chile |

34 |

7.0% |

0.0% |

7.0% |

0.0% |

$ 18,989.00 |

|

|

OECD Average |

N/A |

35.8% |

13.3% |

8.3% |

14.3% |

|

|

|

Source: OECD Taxing Wages (2014). | |||||||